We manage success

We develop ideas and solutions for complex problems and invest in transformative industries like health, energy, and artificial intelligence.

It’s all about the people

We gather data and use powerful algorithms to analyze markets and trends, but ultimately, it's all about the people. Their passion and expertise make a difference.

Tailored solutions

We develop solutions for complex problems in various industries, focusing on health, real estate, and consumer experiences.

Showcase

Large scale real estate

Development and financing of a complex real estate project for 150.000 apartment units with unique challenges by creating a blueprint through testing various combinations of solutions and setups in an iconic building.

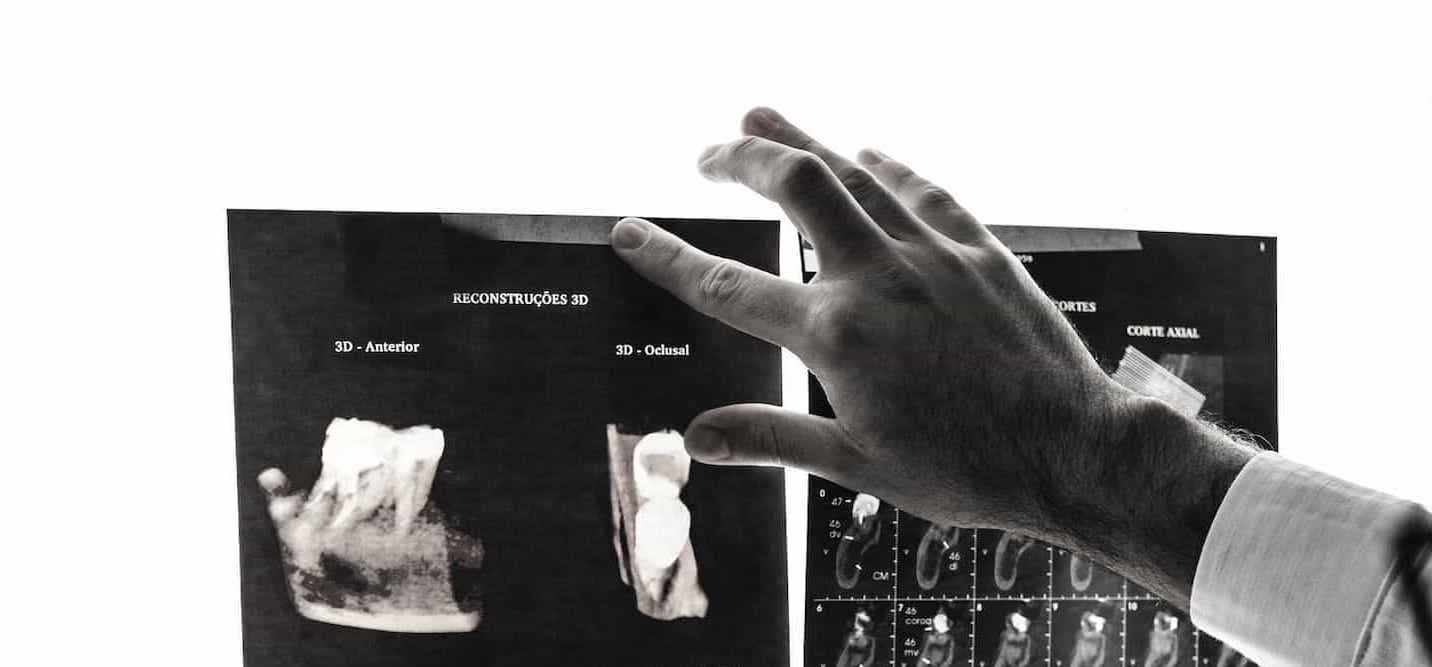

Investing in health

We invest in innovative health projects and develop applications for consumers and health professionals.

Optimizing & automating

Artificial intelligence & blockchain

With our focus on solutions for the financial industry, we invest in automation, blockchain, and artificial intelligence projects.